March 10, 2022

The following text was presented on March 8, 2022, as the spring Seminar in Applied Economics at the Graduate Center.

By Paul Krugman

Olivier Blanchard has a new book on fiscal policy in a world of low interest rates coming out, following on his seminal AEA Presidential Address, with a draft made available for comment. The book will be a must-read for anyone interested in economic policy.

It also got me thinking about some related conceptual issues. Some of them are covered in the book, and I’ve talked about others with various colleagues; responsibility for anything dumb I may say is, of course, entirely mine. But anyway I thought I’d write up some thoughts in a semi-academic paper.

Here’s where I’m coming from: I think I can claim a fair bit of credit for reinvigorating the discussion of very-low-interest rate economics with my 1998 paper on Japan’s liquidity trap, which I worried — rightly — might be a harbinger of similar problems in other nations. Others who shared that worry, including Michael Woodford, Lars Svensson, Gauti Eggertsson and Ben Bernanke (whatever happened to him?) formed what Scott Sumner has dubbed the “Princeton School.”

I think I can also fairly claim that a lot of the analysis in that paper has held up well. My proposed policy solution, however, hasn’t been implemented. I called for central banks to “credibly promise to be irresponsible” — to commit to higher inflation targets, and thereby to achieve the negative real interest rates Japan already needed in the 1990s and everyone seems to need now. Oh, there have been some gestures in that direction: Kurodanomics in Japan, average inflation targeting here. But while there has been widespread acceptance of the notion that r* — the full-employment level of the real interest rate — is low and may often be significantly negative in the current environment, there has been little appetite even for raising the inflation target from 2 to 3, let alone the 4+ many of us have suggested might be necessary.

Instead, most of the discussion is about sustained fiscal stimulus: deficit spending, maybe but not necessarily in the form of public investment, year after year.

The question I’m trying to answer here is why fiscal rather than monetary policy has become the solution of choice for persistent shortfalls in demand. If the problem is that monetary policy can’t drive real interest rates low enough to achieve full employment, why isn’t the answer higher inflation to allow lower real interest rates?

One possibility is that we are simply dealing with a modern version of the gold standard mentality that inhibited an effective response to the Great Depression. But are there better, more substantive arguments for a fiscal rather than monetary response to secular stagnation?

To preview, I don’t think the answer is one-dimensional. To some extent we are dealing with the dead hand of conventional wisdom, with 2% fetters replacing the golden fetters of the 1930s. But there are also some real arguments for keeping the inflation target low if you can still achieve full employment, and both the budgetary and the economic implications of a low “natural” real interest rate make it easier to justify permanent fiscal stimulus than I would have imagined back in 1998.

The first section of this paper reiterates my 1998 argument for credible irresponsibility and talks about the practical difficulties of implementing that strategy. The second section talks about the strange history of two percent — how a seemingly arbitrary inflation number acquired such iconic status that it’s seemingly immovable, even though the quantitative logic that originally seemed to justify it hasn’t stood the test of time. The third section is about the downsides of revising the inflation target up. The fourth section is about the new economics of public debt — why serious economists, Blanchard in particular, are no longer scared by historically high debt-to-GDP ratios and why crowding-out arguments have lost most of their force. A final section asks to what extent revisiting these issues makes a case for a fiscal as opposed to monetary response to the low-rate problem.

1. It’s baaack — again

My 1998 paper was titled “It’s baaack — Japan’s slump and the return of the liquidity trap.” The title was a pop-culture reference meant to highlight the reemergence of a problem — the impotence of monetary policy when interest rates are close to zero — that preoccupied macroeconomists in the 1930s but largely disappeared from discourse for a couple of generations.

My research strategy was to start with an intuition about how things work, devise a toy model — the simplest possible framework that could address the issue — to clarify and firm up my intuition, then apply the insights from that toy model to the data. One virtue of this approach is that the act of formalization sometimes reveals that the way you were thinking about a subject was all wrong. In this case my intuition was that the liquidity trap wasn’t a real problem, that it was an artifact of ad hoc models that didn’t take a sufficiently broad view of the possible channels through which monetary expansion can work. A sufficiently determined effort to increase the money supply, I believed, would always boost aggregate demand.

In an attempt to confirm my intuition, or at least that was the plan, I wrote down a minimalist New Keynesian-type model with rational agents and full intertemporal optimization, subject only to the assumption of temporary price stickiness. To include money, the model needed to have an infinite horizon, but to clear away the clutter I assumed that nothing would change after the first period, so that in practice it became a two-period model of Now and Forever After. Since there was no investment, r* was simply tied down by the Euler condition on consumption.

The results weren’t what I expected. What the model said was both that r* could be negative, and that if it was, the liquidity trap was real. No matter how much you increased the money supply — or, if you included financial intermediaries, the monetary base — it would just sit there, having no effect on aggregate demand unless it increased expectations of future prices.

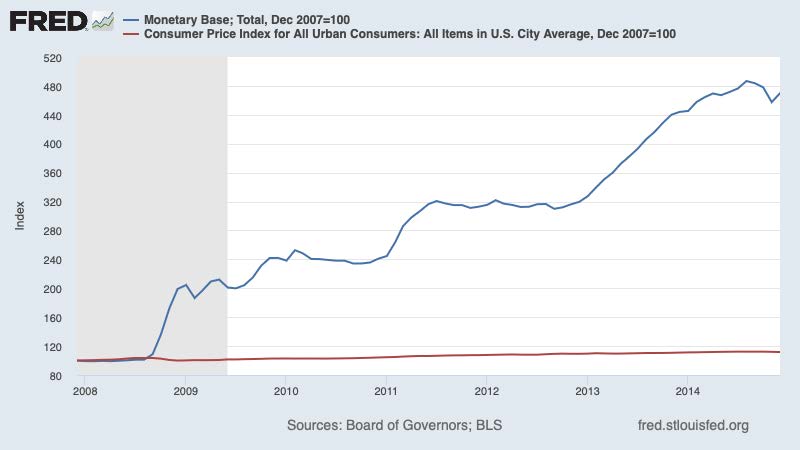

So the model said my initial intuition was wrong. And as Figure 1 shows, events since 2007 have surely confirmed the proposition that even massive increases in the monetary base have little if any effect in a zero-rate environment.

But what about the proposition, drilled into every macro student, that the economy would be self-correcting if prices were perfectly flexible? Still true even at the zero lower bound, but not through the textbook mechanism. A falling price level wouldn’t operate through a rise in the real money supply (in the Ricardian-equivalence world of the model there is no Pigou effect); it would work by reducing current prices relative to expected future prices, that is, creating expectations of future inflation, and hence reducing the real interest rate.

What the 1998 analysis said was, in effect, that an economy that remains depressed even at zero interest rates “wants” expected inflation. With flexible prices it will get there by deflating now so that it can inflate later. But why put it through that wringer? Far better, or so it seemed to me then, to give it the inflation without the deflation, by promising that the central bank will do whatever it takes to assure an inflation rate high enough to get r down to r*.

Of course, central bankers are nurtured in an environment where they are expected to prove their toughness, their sense of responsibility, by showing their willingness to hit inflation with a sledgehammer whenever it rears its head. Hence my assertion that policymakers needed to get beyond that convention, and credibly promise to be irresponsible.

But they haven’t and won’t.

Part of the problem, I believe, is fear of failure. How, exactly, does a central bank commit to future irresponsibility? What’s to prevent future monetary policymakers from reverting to type, and choking off high inflation no matter when their predecessors may have said? And if people believe that will happen, current monetary expansion will be ineffective under a zero lower bound.

True, a central bank could be opportunistic. If events — say, massive spending associated with a pandemic — happen to generate a burst of inflation, the central bank could choose to ratify the higher rate rather than squeeze it all the way back to the old target. And there is some possibility that the Fed will do that — accept inflation closer to 3 than to 2 when the current supply-chain disruptions fade.

But central banker resistance to a higher target goes beyond unwillingness to make promises they might not be able to keep. I’ve been on this case for decades; I’ve tried to make the case for raising the inflation target both in public and behind closed doors. I’ve had about as much impact as the post-2008 rise in the monetary base had on the price level. But why?

2. The Tao of two

How did a 2% inflation target become enshrined as, more or less literally, the gold standard of responsible monetary policy?

In a proximate sense, we can blame New Zealand, which in 1989 became the first country to formally set an inflation target, originally at 0 to 2 percent a year, and was quickly emulated around the world. But the intellectual groundwork for this target had been laid over the previous decade.

I’m not a professional intellectual historian, of economics or anything else, so I’m happy to be corrected in my interpretation of how things played out. But my understanding is that by the late 1980s, following the successful (if immensely costly) experience of bringing the inflation of the 1970s under control, there was a fairly lively debate about what inflation rate should be the goal in the longer run.

A significant number of economists and, perhaps even more so, central bankers wanted true price stability: zero inflation. On the other hand, some economists were worried, even then, about the zero lower bound. For example, in 1991 Larry Summers worried that with zero inflation the central bank might find itself unable to cut rates enough to ward off a recession.

It seemed at the time, however, that setting a low but positive target for measured inflation might satisfy both sides. There was a widespread view, especially although not only among conservatives, that failure to account for quality improvements and other factors was causing official inflation numbers to overstate the true rate of price increase — for example, Alan Greenspan made repeated statements to that effect. So you could argue that 2 percent inflation was really zero inflation, or close enough to it to satisfy stable price advocates.

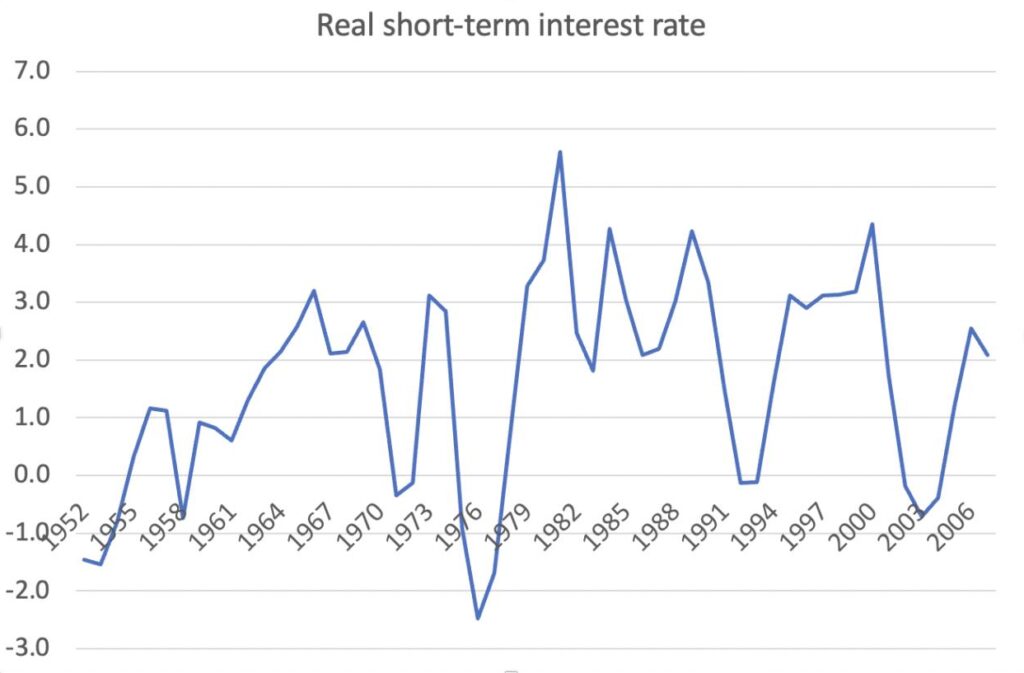

At the same time, modeling efforts like Reifschneider and Williams (1999) suggested that a 2 percent target would be high enough to make the zero lower bound unimportant: The economy would hit that bound only rarely and briefly. It’s not hard to see why the models reached that conclusion. Figure 2 shows the annual real short-term interest rate (on 3-month Treasury bills) between 1952 (when an accord with the Treasury gave the Fed independent power to set rates) and the eve of the global financial crisis; I calculate expected inflation using the average growth of the core PCE deflator over the previous three years.

As you can see, this real rate breached -2, the lowest level possible with a 2 percent target, only once over that 55-year span. It seemed safe to assume, then, that with 2 percent inflation the ZLB would almost never be a problem.

The apparent happy coincidence of the priorities of opposing economic factions made a 2 percent inflation target extremely appealing, and once that had become a widespread norm it acquired iconic status; keeping inflation near 2 became a badge of central bank respectability and success.

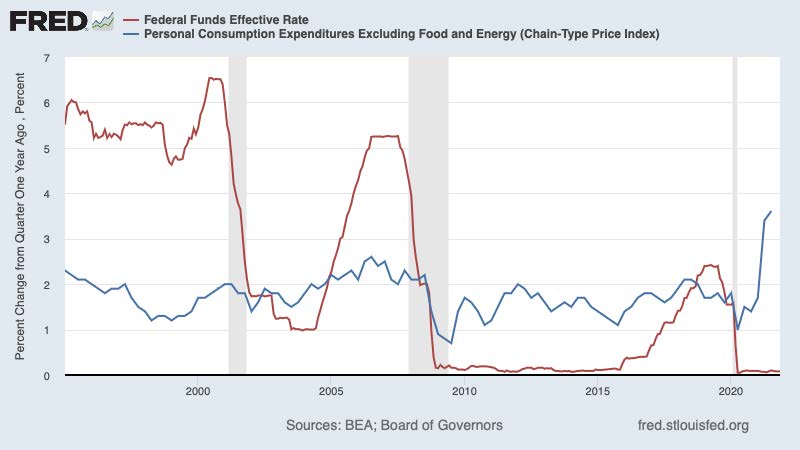

Unfortunately, the belief that 2 percent inflation would ward off any dangers from the ZLB proved quite wrong. As Figure 3 shows, the Fed has been quite successful at keeping core inflation near 2 since the early 1990s; it has also spent more than a third of that period at or near the zero bound, that is, monetary policy has been greatly constrained by the inability to get real interest rates low enough.

So the quantitative arguments made on behalf of a 2 percent target, if they were ever valid, haven’t been valid for a long time. And given weak or negative growth in advanced-economy working-age populations, there is every reason to believe that r* will remain low or negative for a long time to come.

Yet as I said, the discussion around responses to secular stagnation seems much more focused on fiscal policy than on changing the inflation target. Why?

3. Reasons not to move

I happen to own a copy (picked up fortuitously in a British used-book store) of the 1934 book The Great Depression by Lionel Robbins — published before Robbins became a convert to Keynesianism. At the top of his recommendations for ending the Depression was … a return to the gold standard. His argument was, I think, incoherent even by the standards of the time. But it showed the power of conventional notions of monetary responsibility.

Surely there is something of that to the resistance of central bankers to any suggestion that they move off the 2 percent target, despite the collapse of that target’s original rationale. But there may be more to it than that.

It’s true that conventional measures of the cost of inflation, which tend to focus on the “shoe-leather” costs imposed when cash becomes less useful as a medium of exchange because it depreciates in value, are trivial unless inflation is much higher than anyone is suggesting as a target. However, there are other possible costs of raising the inflation target that are much harder to quantify but may loom larger.

One is that even moderate inflation may degrade the usefulness of money as a unit of account. Inflation these past several decades hasn’t just been fairly low, it has been highly predictable. So you can make long-term contracts and commitments with a pretty good idea of what a dollar will be worth five, ten or even twenty years from now. Would a long-term commitment to, say, 4 percent inflation reduce this predictability enough to be a serious concern?

I don’t think anyone knows. The late 1980s were an era of roughly 4 percent inflation, and I don’t recall — nor have I seen other accounts suggesting such a thing — that inflation at that rate was a major problem for planning. But we don’t have any data I’m aware of that can put a number to this question.

A somewhat different, and in a way contradictory case for low inflation, even at a rate sufficient to erode purchasing power significantly over time, may be that 2 percent is low enough to make people stop paying attention. As Blanchard pointed out in another influential paper, the accelerationist Phillips curve of the ’70s and ’80s seems to have reverted back to an old- fashioned relationship between the level of unemployment and the inflation rate. And one reason, he suggests, is that inflation is low enough to reduce its “salience” to economic decision-making.

In economies with persistent double- or even triple-digit inflation, people think about inflation all the time, and their expectations drive many of their decisions. In a 2 percent economy, not so much. With inflation as low as it has been in major advanced economies for the past few decades, you might say that we have managed to restore money illusion; people think in dollars, not dollars adjusted for expected inflation.

This has advantages for policymakers, because it gives them more room for error. They don’t need to worry that letting the economy run too hot for a little while will lead to embedded inflation, or for that matter that letting it run too cold will lead to deflation that is hard to reverse.

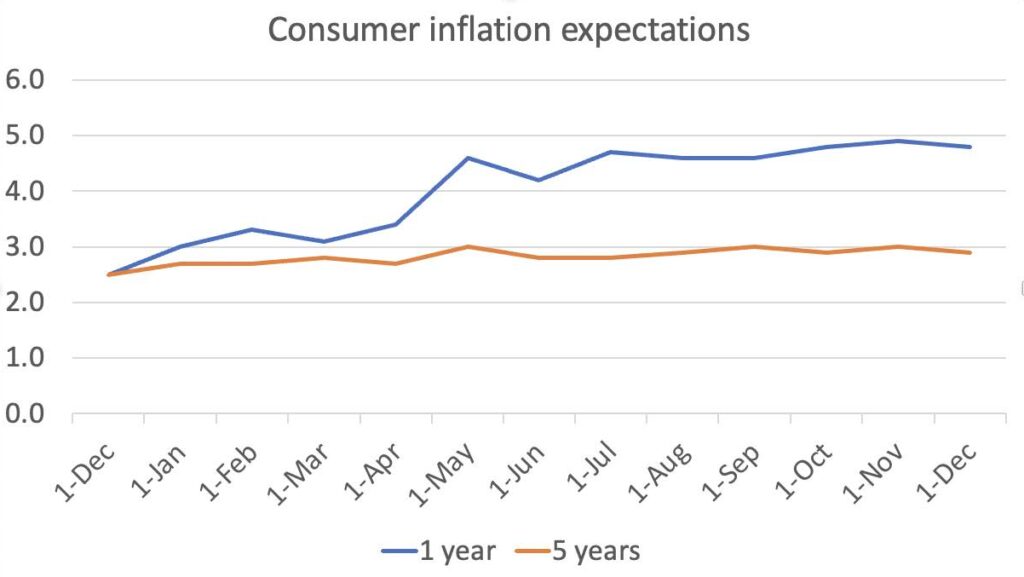

Indeed, we may be seeing those benefits right now. Figure 4 shows median consumer expectations from the Michigan surveys from Dec. 2020 through Dec. 2021:

Short-term expectations have soared along with actual inflation, but longer-term expectations have risen much less, implying that consumers expect inflation to return to normal levels after around a year. This probably means that inflation has not yet become embedded in wage- and price-setting, which in turn makes it more likely that the Fed can cool inflation down without needing to push the economy into recession.

The low salience of inflation may also be beneficial to consumers and businesses, simply because they can conserve cognitive resources.

Would raising the target from 2 to 4 restore enough salience to inflation to undermine these advantages? Who knows? But it’s at least enough of a risk to provide some incentive to look for other policy solutions to macroeconomic weakness. And the case for alternative solutions is made stronger by the very fact that we appear likely to spend a long time in a very low-interest-rate environment.

4. Debt and transfiguration

In the aftermath of the 2008 financial crisis, and especially after the 2010-12 euro area crisis, policymakers and pundits were obsessed with the supposed dangers of high public debt. Those of us arguing that debt was greatly overrated as an issue were fighting an uphill battle, and in the lay discussion to some extent still are.

The argument became much easier, however, after Blanchard’s landmark presidential address. Blanchard’s main point was simple: fears of snowballing debt are misplaced when interest rates are low, and especially when they are below the economy’s growth rate. The basic equation of debt dynamics shows the rate of change of d, the ratio of debt to GDP, as follows:

𝑑̇ = −𝑏 + (𝑟 − 𝑔)𝑑

where b is the primary fiscal balance as a share of GDP, r the real interest rate and g the economy’s growth rate. If r

At the time of writing, the Congressional Budget Office expects real potential GDP to grow at an annual rate of 1.8 percent over the next decade; meanwhile, the interest rate on 10-year inflation-indexed bonds is -1 percent. Federal debt is 122 percent of GDP. So the arithmetic says that we could stabilize the debt ratio at its current level while running a sustained primary deficit of more than 3 percent of GDP, that is, while providing substantial fiscal stimulus on a permanent basis.

Still, don’t budget deficits crowd out private investment and therefore hurt long-run growth? In addition to pointing out that low interest rates undermine one main reason for worrying about debt levels, Blanchard also argued that they undermine or at least greatly reduce concerns about crowding out — because an economy with ris also an economy that may well meet Diamond’s 1965 criterion for dynamic inefficiency. That is, it may be an economy in which less capital accumulation is welfare-improving.

I’ve always found the dynamic inefficiency argument a bit abstruse, but a 2008 discussion by Phillipe Weil suggests a simple graphical way to make the point.

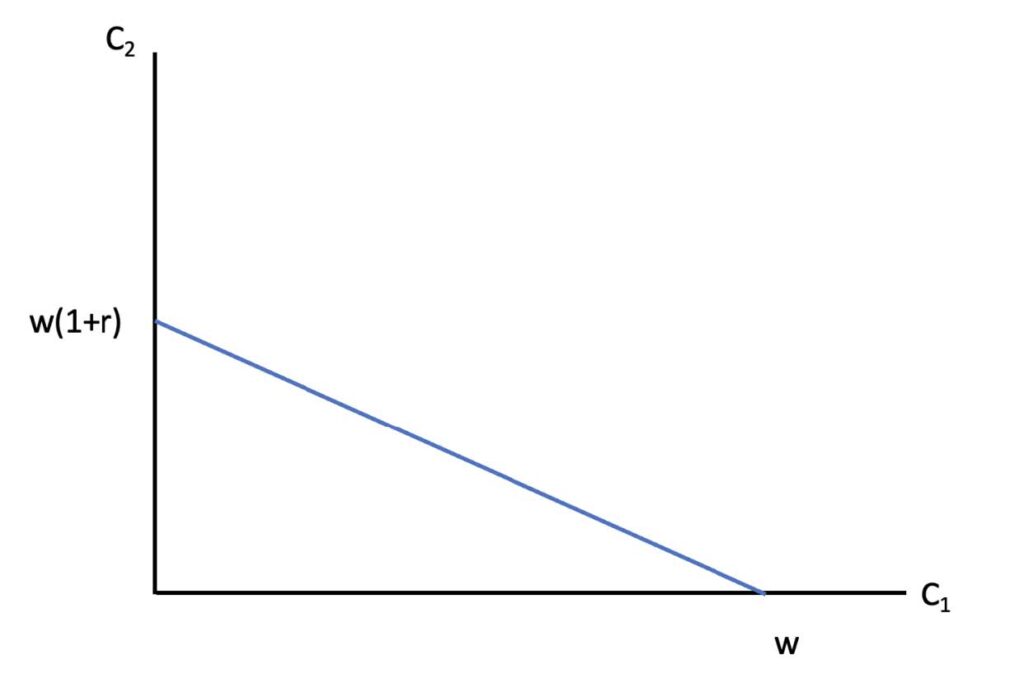

Consider a standard overlapping generations model in which each generation lives two periods, working during the first and living off savings in the second. Assume also one of Blanchard’s extreme cases, a linear production function, in which each unit of consumption foregone during an individual’s first period can be used to accumulate a unit of capital that yields 1+r units of output in the second period. If capital is the only asset and there is no tax-and-transfer system, each individual has the consumption possibility frontier shown in Figure 5, where w is the income earned from labor in the first period, C1 is consumption in the first period, and C2 is consumption in the second.

But now imagine that we can create a permanent institutional mechanism under which each generation pays part of its earned income to the retired previous generation, under the expectation that the next generation will perform the same service. This mechanism could take the form of a pay-as-you-go retirement system, or simply the existence of a stock of government debt that each generation can buy when young then sell to the next generation.

And assume that each successive generation has higher earned income than its predecessor — specifically 1+g times as high — either because of population growth, technological progress, or both.

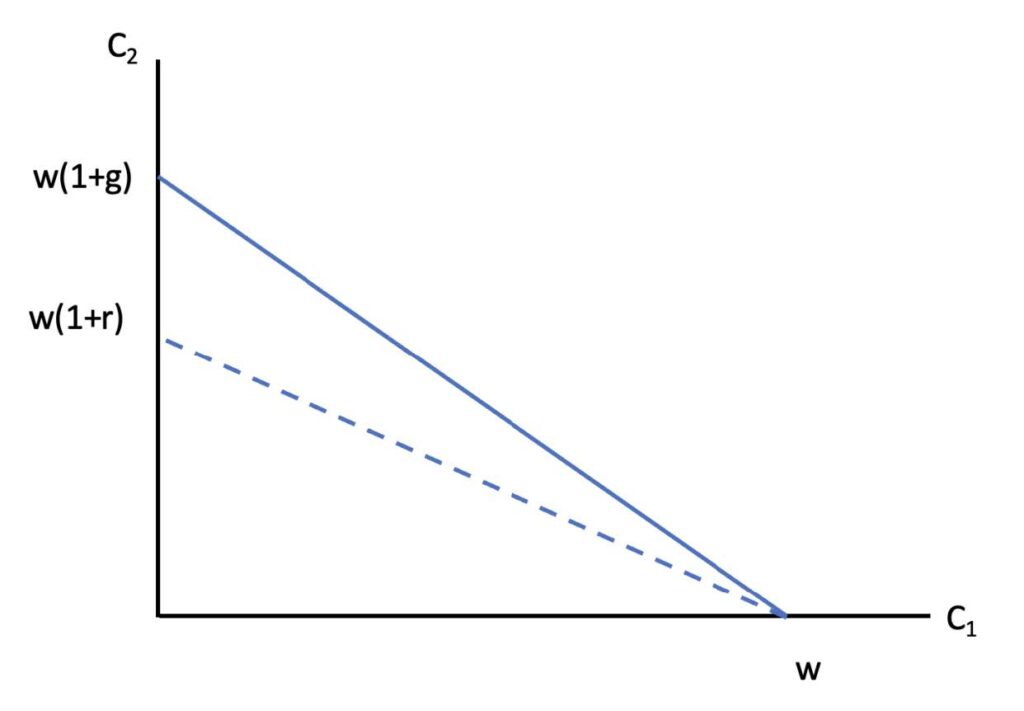

If g>r, this model tells us that the economy shouldn’t accumulate capital, that each generation should plan instead to live off transfers from the next generation. For this alternative mechanism shifts the consumption possibility frontier for every generation outward, as in Figure 6.

This is clearly an extreme case driven by the assumption of a linear production function in which r is constant. With diminishing returns to capital, the optimum involves reducing the capital stock to the golden rule point where r=g. But it does suggest that in a world with r

As Blanchard points out, this result can be softened or reversed once we make a distinction between the interest rate on government debt, presumably a safe asset, and what appear to be higher rates of return on private investment. The appropriate r in the r-g comparison is somewhere between these rates. However, social rates of return on private capital may not be as high as they appear, because a significant fraction of corporate profits probably represents monopoly rents rather than a return to investment.

Also, remember that the question I’m asking here involves a tradeoff between sustaining aggregate demand via deficit spending versus sustaining it with negative real interest rates achieved with a sufficiently high inflation target. So what matters isn’t the average return on private investment; it’s the rate of return on those forms of investment that would be stimulated by negative real interest rates, which are probably quite different from private investment as a whole.

Which brings me to the final section, on how we should think about inflation targets in the light of the rethinking of public debt.

5. To inflate or not to inflate

Let’s return to the original issue. Since the late 1990s we’ve been aware that the liquidity trap, a situation in which monetary policy can’t assure adequate demand, is a real possibility. Over the past decade this has also started to look like a chronic concern, not just in Japan but in the advanced world as a whole: Once the economic effects of the pandemic recede, we’re likely to find ourselves back in a world of secular stagnation, with r* negative much of the time. And a 2 percent inflation target by itself seems unlikely to be sufficient to resolve this problem.

The seemingly natural answer would be to raise the inflation target. But central bankers are firmly opposed, and conventional wisdom among those willing to take any of this seriously seems to have migrated toward the use of persistent fiscal stimulus to raise r* sufficiently that monetary policy can do the job with the existing inflation target.

It’s important to be clear that relying on a fiscal solution rather than a higher inflation target is, in effect, a choice to pursue higher public spending at the expense of lower private investment. As I said, a liquidity-trap economy in effect “wants” inflation; choosing not to accept that inflation is a decision to impose lower private investment than the free-market economy would choose on its own.

The main reason to engage in this de facto policy of crowding out is the suspicion that there are significant costs to inflation, even if it is in the low single digits, combined with the belief that the social costs of crowding out some private investment are low.

Let me add one additional reason to downplay the costs of crowding out, by asking which kinds of private investment would actually be stimulated by a regime of negative real interest rates.

It’s a dirty little secret of macroeconomics that business investment appears to be relatively insensitive to the cost of capital in general and real interest rates in particular; see Caballero for a summary of the evidence. Instead, interest-rate policy works mainly though housing. This makes considerable sense: much business capital is relatively short-lived, so the cost of financing should be a relatively small factor in the spending decision, while housing is extremely long-lived.

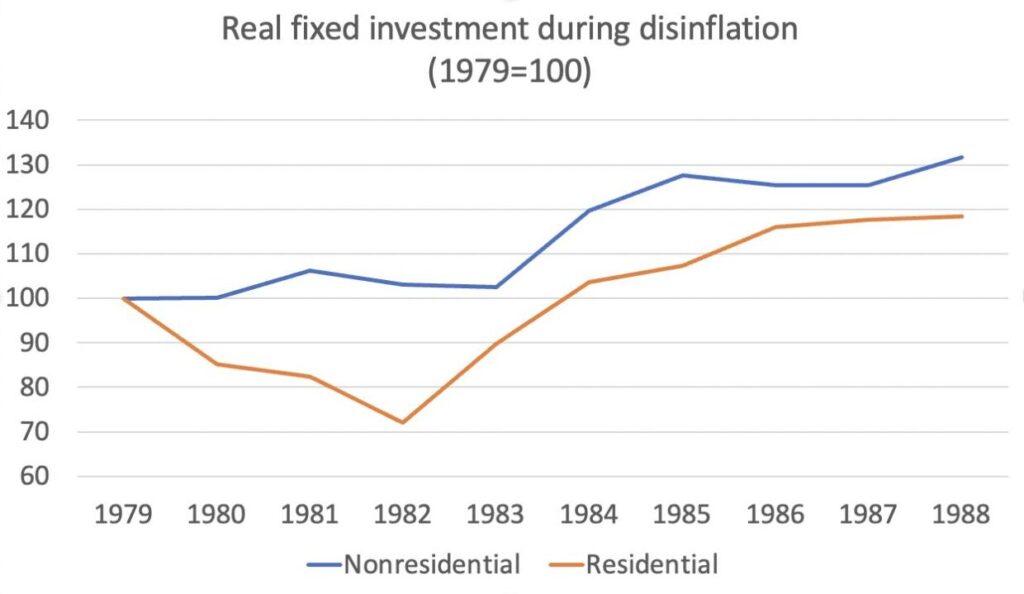

Figure 7 illustrates one of the closest examples we’ve had to a natural experiment. During the Reagan years the Fed pursued a tight-money policy to achieve disinflation even as the Reagan administration engaged in fiscal stimulus. Residential investment plunged, while nonresidential investment was barely affected. What this implies in the current context is that choosing to keep target inflation low while engaging in fiscal stimulus mainly means substituting government expenditure for residential investment.

And in the U.S. context, at least, the tax preference for housing — not simply the mortgage interest deduction, but the fact that the services provided by owner-occupied housing don’t count as taxable income — presumably means that the relevant investment crowded out by deficit spending has a relatively low rate of return. So this is a further argument in favor of a fiscal rather than monetary response to secular stagnation.

One more argument, suggested to me by Blanchard in correspondence, involves political economy. Suppose that you’re a center-left economist who would like to see more social spending, for example in reducing child poverty. A strategy of raising r* with deficit spending rather than achieving negative r* with expected inflation will make it easier to afford such initiatives! (Since central bankers who believe in low inflation also tend on average to be center-right, will this observation make some of them reconsider their positions?)

I would, however, add one caveat: I’m still worried about how we will respond to future economic downturns.

I’ve written this paper largely as if r* were a constant or at least slowly moving number. In reality, however, a low-inflation economy appears to be subject to large fluctuations driven by private-sector overreach and retrenchment: the commercial-real-estate-driven cycle of the late 80s/early 90s, the tech boom and bust of the late 1990s, the monstrous housing bubble of the mid-2000s.

Can we offset the inevitable downturns with fiscal policy? In principle, yes, although government purchases — as opposed to transfer payments — generally can’t be ramped up quickly. As we saw after the 2008 crisis, however, the political economy of fiscal response is often difficult, which is one important reason to make a technocratic central bank the first line of defense against recessions.

To make this business cycle strategy workable, however, it’s not sufficient that the average nominal interest rate is positive. That average rate has to be sufficiently far above zero that there is enough room to cut when the inevitable downturns happen and monetary expansion is required. Will a combination of persistent fiscal stimulus and 2 percent inflation provide sufficient room for action when needed? I’m worried that it won’t.

Nonetheless, at the moment the case for a fiscal response to the threat of a liquidity trap, as opposed to a higher inflation target, is stronger than the “Princeton School” envisaged in the early 2000s. Maybe central bankers don’t need to be credibly irresponsible after all.