In this research spotlight, Salvatore Morelli and his colleagues analyze ways of studying wealth concentration, as well as new findings on the dramatic shifts in the U.K.

In recent years, economists have increasingly focused on the distribution of personal wealth. In particular, many have focused on the empirical evidence about the very top shares of the wealth distribution, and on how this has changed over time.

A paper by Facundo Alvaredo of the Paris School of Economics, the late Anthony B. Atkinson, and Stone Center Senior Scholar Salvatore Morelli, who also directs The GC Wealth Project, presents evidence about changes in top wealth shares — an essential part of understanding the evolution of the modern economy — in the United Kingdom. The study covers more than a century, from the Gilded Age before the First World War to the present.

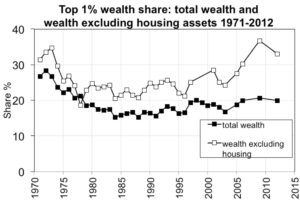

The paper, “The Concentration of Wealth in the UK Over More Than a Century,” offers both methodological contributions and substantive findings. In terms of methodology, the researchers take a new look at the wealth that individuals leave at death: their estates. By exploiting more fully — through the use of a method that economists refer to as the mortality multiplier method — the available data related to the taxation and administration of estates, the researchers constructed a new series of top wealth shares covering almost the entire period from 1895 to the present day. “The information on estates has served for the estimation of the distribution of wealth among the living through the application of the mortality multiplier method, but has never been the object of specific analysis,” the researchers write. In addition, the study shows the importance of separating the role of housing wealth, and provides evidence of the increasing concentration in the distribution of wealth excluding housing. In the view of the authors “housing wealth has moderated the tendency for concentration to increase in other forms of wealth.”

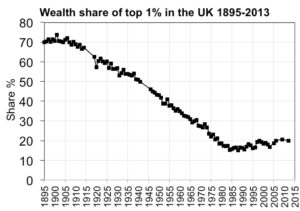

The researchers’ substantive findings demonstrate the dramatic changes in the distribution of wealth in the United Kingdom over the course of more than a century. At the beginning of the time period studied, the wealthiest 1 percent of individuals held about 70 percent of the United Kingdom’s total wealth. That share began to fall after 1914, and the decline continued until around 1980, when it reached about 16 percent. However, at that point, the direction reversed. From the mid-1980s forward, the share of the top 1 percent — currently about half a million individuals — has increased.

In addition to social justice concerns, there are many policy reasons to get an accurate picture of the concentration of wealth, such as concerns related to the housing market as well as the distributional impact of the large programs of long-term bond purchase by central banks, the researchers write in their conclusion. However, the wealth of the 1 percent cannot be adequately captured by standard household wealth surveys alone. “We believe that there is considerable value in a multi-source approach to investigating the distribution of wealth,” the researchers write. “No single method is sufficient on its own, and we need to have as full a picture as possible of the advantages conveyed by large wealth-holdings.”