A new study by Stockholm University’s Arvid Lindh and the Stone Center’s Leslie McCall reveals preferences among Americans for policies that reduce pay inequality within major U.S. corporations — which in turn challenges assumptions about support for free markets.

The idea has become widely accepted in the social science literature: the majority of Americans don’t think the federal government should enact policies that reduce income inequality. Despite decades of rising inequality, less than 50 percent of respondents to social surveys support direct government redistribution of income from the rich to the poor, as many studies have shown.

Adding to their other work challenging the conclusion often drawn from the research — that Americans are indifferent about high levels of inequality — Arvid Lindh and Leslie McCall recently published a study that investigates public support for a different method of reducing inequality: in the labor market. By focusing on support for whether large companies should reduce pay differences between employees with high pay and those with low pay, the researchers are expanding the framework for assessing public preferences about how the U.S. should reduce inequality, and also challenging assumptions about free market ideology.

Drawing on responses to new questions that they designed for the General Social Survey (GSS), Lindh and McCall directly compared support for and opposition to these two different methods of reducing inequality: tax and transfer policies (in which the federal government is the agent of change), and reducing pay inequality in the labor market (in which large companies are the agents of change).

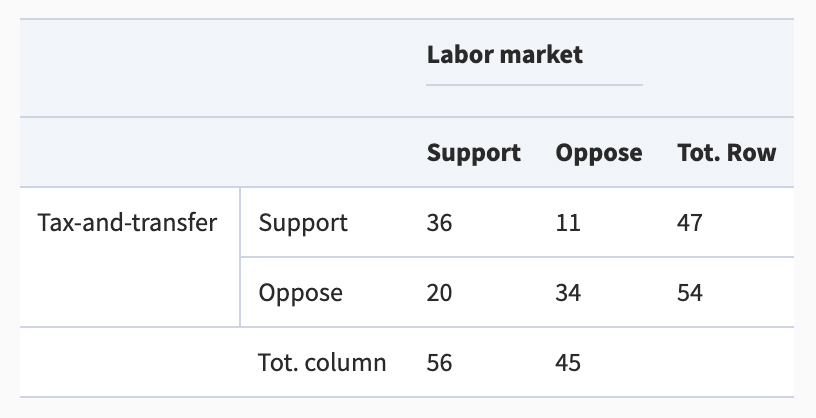

To measure support for government redistribution, the researchers examined the GSS’s widely used question that asks whether “the government ought to reduce the income differences between the rich and the poor, perhaps by raising the taxes of wealthy families or by giving income assistance to the poor.” In the researchers’ new parallel version of this question, respondents were asked whether “major companies ought to reduce the pay differences between employees with high pay and those with low pay, perhaps by reducing the pay of executives or by increasing the pay of unskilled workers.” Respondents supported one of these two methods, neither, or both. (See the table below, which appears as Table 2 in the article.)

Table 2

Percent support for the labor market and tax-and-transfer methods of reducing inequality in the USA

Notes: Support and opposition are measured, respectively, as responses in the top three and bottom four categories of a seven-category scale. The sample is weighted.

Source: 2014 General Social Survey

As the table shows, less than half — a total of 47 percent of respondents — support reducing inequality through taxes and transfers. Yet a greater share — a total of 56 percent — support labor market methods to reduce inequality. Notably, 20 percent support labor market methods but not tax and transfer policies. Taken together, these findings counter the established idea that there is little public support for interfering in markets.

“You have to shift your perspective and look at all the inequality that’s in the labor market, such as high CEO pay, low pay for minimum wage workers, and the lack of protections, benefits, and security for workers,” says McCall. “If we just focus on that — these problems in the labor market — people recognize it as unfair.”

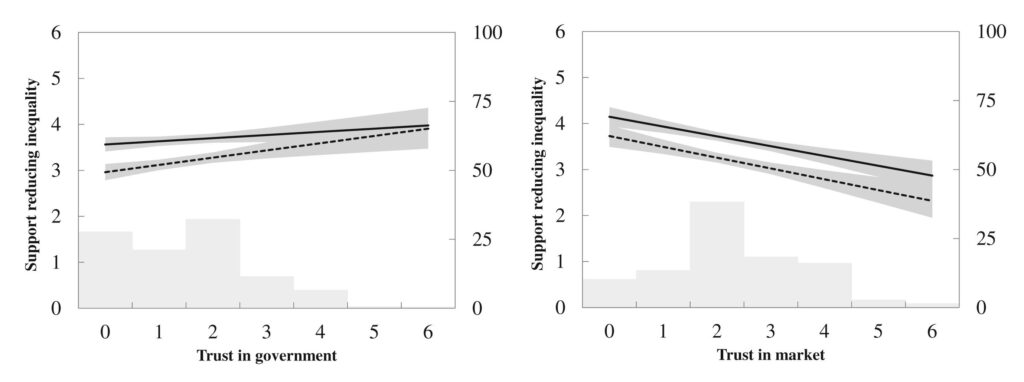

Responses to a separate set of new questions show considerable public distrust of major companies, although distrust of the government remains higher. (See the figure below, which appears as Figure 1 in the article.) Like the findings described above, this distrust of corporations also challenges assumptions about public support of the free market.

Figure 1

Notes: Adjusted predicted values of support for the labor market (solid lines) and tax-and-transfer (dashed lines) methods of reducing inequality in the USA by trust in government (left panel) and trust in market (right panel), holding household income and socio-demographic controls at mean values. Full scales of variables are shown on x and y axes, although y-standardized analyses reveal similar results. Shaded areas around each line represent 95% CIs. Piles at the bottom indicate the distribution of the covariate (in percent, secondary axis). See Online Appendix C for model estimates.

“It is widely agreed among scholars that preferences for less inequality, based on support for explicit government redistribution, are modest in the U.S. relative to other countries, and unresponsive to the sharp rise in economic inequality,” the researchers write in their conclusion. “Moreover, in both scholarship and elite discourse, Americans are believed to embrace free market principles that preclude non-profit-driven, equity-based interventions in employer pay-setting practices. However, our review of available survey and anecdotal evidence (e.g. political actions and protest movements), as well as our own initial empirical investigation into these claims, indicates that Americans have a more egalitarian, and less free market, orientation toward the market wage than often acknowledged.”

These findings make sense of recent movements at Apple, Amazon, and Starbucks to form unions as a way to negotiate for more equitable pay and working conditions. With a full two-thirds of Americans supporting ways to reduce inequality (see the table above), policymakers have many tools at their disposal to enact widespread change.

Read the Paper:

Bringing the Market in: an Expanded Framework for Understanding Popular Responses to Economic Inequality (open access)